NEW DELHI: India launches the most sweeping tax reform since independence with GST 2.0 on September 22, 2025. The revolutionary three-slab system promises to slash prices on essential items dramatically. Economists predict this will trigger the biggest consumer spending boom in decades.

The GST Council approved the landmark reforms during its 56th meeting on September 3. The new system eliminates complex tax structures that confused businesses for years. Only three tax rates will remain: 5 percent, 18 percent, and 40 percent.

Essential Items Get Major Price Relief

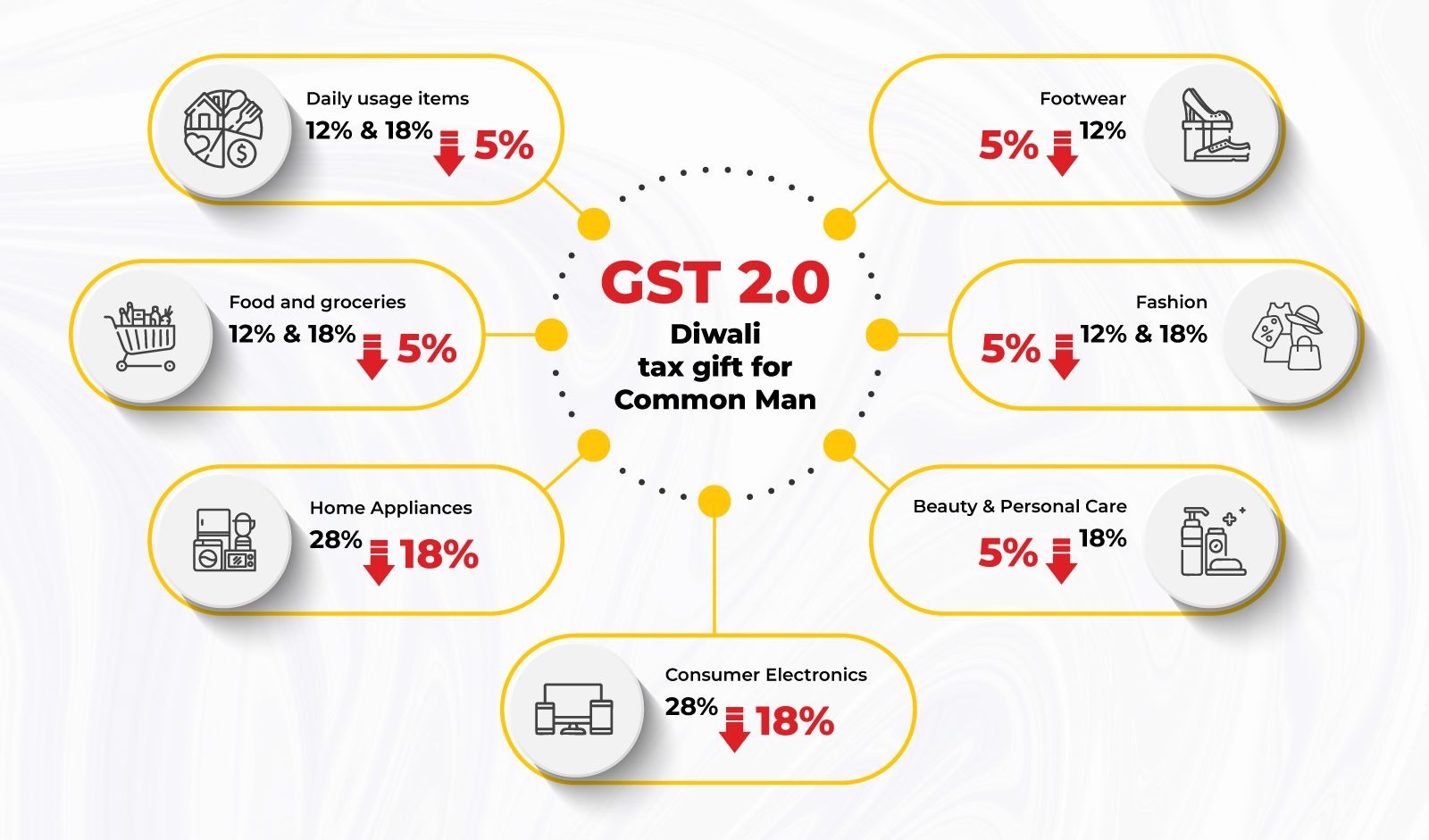

The government moves most everyday items to the lowest tax bracket. Food products, medicines, and household essentials now fall under 5 percent GST. Previously, many of these items carried 12 percent or 18 percent taxes.

Processed foods like packaged snacks and ready-to-eat meals become significantly cheaper. Soaps, detergents, and personal care items drop to 5 percent taxation. Health insurance premiums also receive substantial reductions under the new structure.

Nearly 90 percent of items from the previous 28 percent slab move to 18 percent. This massive shift will reduce costs for consumer durables immediately. White goods like refrigerators, washing machines, and air conditioners become more affordable.

Revolutionary Three-Slab System Launched

The new structure eliminates the confusing 12 percent and 28 percent tax slabs entirely. Businesses can now calculate taxes more easily with just three rates. The simplified system reduces compliance costs for companies significantly.

Essential goods receive zero percent tax or 5 percent maximum rates. Standard goods and services carry 18 percent GST across categories. Luxury items and sin goods face the new 40 percent rate.

The 40 percent slab targets premium cars, motorcycles, and tobacco products specifically. These luxury and harmful items will fund the tax relief for essentials. The government maintains revenue while redistributing tax burden efficiently.

Massive Economic Impact Expected

Economists predict GST 2.0 will boost GDP growth by 1.5 percent annually. Lower prices will increase consumer spending across all income groups. The reform addresses inflation concerns that plagued middle-class families recently.

Manufacturing costs will decrease substantially due to simplified tax calculations. Companies can plan investments better with predictable tax structures now. The reform supports the government’s Make in India initiative strongly.

Small and medium enterprises benefit most from the simplified compliance requirements. The reduced paperwork cuts administrative costs for businesses dramatically. Many informal businesses may join the formal economy now.

Consumer Spending Revolution Begins

Retail analysts expect a consumption boom starting September 22 immediately. Lower prices will increase purchasing power for essential goods significantly. Families will have more money for discretionary spending categories.

The automobile sector anticipates strong demand growth from reduced taxes. Electronics and home appliances will see increased sales volumes immediately. Consumer durable companies prepare for higher production to meet demand.

Food and beverage companies celebrate the move to lower tax slabs. Restaurant chains and food processors expect increased consumer footfall now. The hospitality sector prepares for higher business volumes.

Business Community Celebrates Reform

Industry leaders call GST 2.0 the most business-friendly tax reform ever. The Confederation of Indian Industry praises the simplified structure enthusiastically. Manufacturing associations predict increased investment flows into production capacity.

Software companies developing GST compliance tools face major system updates. The transition requires extensive testing of new tax calculation systems. Businesses prepare training programs for accounting teams across organizations.

Tax consultants and chartered accountants expect reduced workload from simpler compliance. The legal complexity of GST calculations decreases substantially now. Professional service fees may decrease due to simplified processes.

Revenue Impact and Fiscal Strategy

The Finance Ministry projects neutral revenue impact from the reforms. Lower rates on most items balance against increased compliance levels. More businesses joining the tax net compensates for rate reductions.

The government targets expanding the tax base through simplified compliance. Informal sector businesses find it easier to register now. Digital payment adoption will increase further with lower tax rates.

State governments support the reform despite initial revenue concerns. The compensation mechanism ensures states maintain their tax collections. The unified market will boost interstate trade volumes significantly.

Implementation Challenges Ahead

Businesses rush to update their accounting systems before September 22. Software vendors work overtime to deliver GST 2.0 compatible solutions. The tight timeline creates implementation pressure across sectors.

Retailers must update price tags and billing systems immediately. Point-of-sale systems require urgent software updates everywhere. Customer service teams prepare to handle pricing queries from consumers.

Government tax officials receive intensive training on the new system. The GSTN infrastructure undergoes major upgrades to handle changes. Backup systems ensure smooth transition during the changeover period.

Global Recognition for Tax Innovation

International tax experts praise India’s bold reform approach. The World Bank calls GST 2.0 a model for developing economies. Other countries study India’s digital tax administration systems closely.

The reform strengthens India’s position in global competitiveness rankings. Simplified taxation attracts more foreign direct investment into manufacturing. Export competitiveness improves due to lower input tax costs.

Economic analysts predict GST 2.0 will accelerate India’s growth trajectory. The reform addresses long-standing demands from industry and consumers. September 22 marks a historic turning point in India’s economic journey.

Smart bankroll management is key with any game, especially when exploring platforms like 999jili app. Setting limits, as they suggest with their security features, is a solid strategy for sustained play. Don’t chase losses!

It’s fascinating how easily accessible strategic gaming has become! Seeing platforms like 999jili login emphasize security and diverse funding options is smart – crucial for responsible enjoyment & maximizing potential. Interesting times!

Solid article! Thinking about bankroll management & strategic play really elevates your game. Setting limits, like in the 999jili 999jili game security center, is key for long-term success. Great insights!

Anyone tried megabahiscasino? I’m always lookin’ for new spots to spin the reels, ya know? Let me know if it’s legit before I drop any coin!

The games here are pretty crazy you will lose track of time. Check out the link below hytalejuego

Playtimelogin… alright, time to see what this is all about. Hopefully, hindi sakit sa ulo yung login process! playtimelogin

Gonna try my luck on 001gamebet tonight. Their sign-up bonus is kinda tempting. Hopefully, it’s not too good to be true! 001gamebet

DDwin is a solid choice. Registration was easy, and they have some fun promos running. I’m enjoying the experience so far! Take a peek: ddwin

Spinning the reels on 777win66 tonight. Fingers crossed for that lucky 7! Anyone else playing there? I am feeling lucky, check it out 777win66.